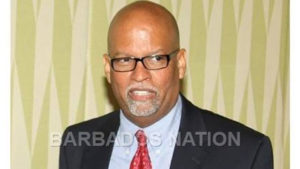

Dr. Arnold McIntyre, who headed the IMF Mission to St. Kitts and Nevis to conduct the Article IV Consultation, has suggested that Caribbean islands review the tax incentives they currently grant individuals and businesses.

Dr. Arnold McIntyre, who headed the IMF Mission to St. Kitts and Nevis to conduct the Article IV Consultation, has suggested that Caribbean islands review the tax incentives they currently grant individuals and businesses.

Dr. McIntyre, Deputy Division Chief in the Caribbean Division 1 of the IMF’s Western Hemisphere Department was in Barbados recently where he expressed concern that regional governments could be losing millions of dollars in revenue from these concessions.

This, he said, was not healthy given that the region was struggling economically.

“When we look at what is underpinning these large deficits and we look at the revenue side, we have pervasive tax incentives,” Dr. McIntyre told the 33rd Adlith Brown Memorial Lecture at the Central Bank of Barbados.

He said IMF estimates suggested that legislative and discretionary tax incentives being granted by some Eastern Caribbean states were leading to revenue losses of between four and nine per cent of gross domestic product (GDP).

“We have significantly undermined our revenue base. In many ways, the granting of tax incentives has been seen as a single panacea to overcome the widespread distortions and inefficiencies in the countries. That is, we have provided a solution but we haven’t tackled the problem,” McIntyre said.

Pointing to Mauritius, he said that country’s parliament had decided some time ago to remove the ability to grant tax incentives from the authority of the minister, adding that “there is a lesson there” for the region.

He said Caribbean economies also had weak expenditure controls, pointing out that there was especially “significant” fiscal risk in relation to state-owned enterprises.

He explained that in the region central government finances amounted to about eight per cent of GDP, compared to the five per cent of GDP in emerging markets.

However, the economist said when government expenditure extended beyond central government to include the non-financial public sector, that wage bill could reach up to 20 per cent of GDP.

“We have built up a very large state and what has happened, it has become costly and we don’t have the growth rates and associated revenue streams to maintain it,” he said.